The 6-Minute Rule for Navigating Turbulent Markets: How a Currency Volatility Meter Can Help You Stay Ahead

Getting through Turbulent Markets: How a Currency Volatility Meter May Help You Stay Ahead

In today's fast-paced global economic condition, economic markets can be highly erratic, with swift variations in money market values ending up being the standard somewhat than the exemption. For organizations and investors identical, understanding and managing currency dryness has ended up being an vital ability. In this blog blog post, we are going to check out how a currency volatility meter may aid you keep ahead of time in rough markets.

What is Currency Volatility?

Unit of currency dryness recommends to the degree of variation in the worth of a currency relative to various other unit of currencies. It is affected through different aspects such as economic red flags, geopolitical celebrations, passion costs, and market belief. High levels of unit of currency volatility may create substantial risks but likewise opportunities for those who are well-prepared.

The Importance of Monitoring Currency Volatility

Fluctuations in unit of currency values can possess a extensive impact on services engaged in global trade or expenditures. Swap fee movements straight have an effect on import and export prices, earnings scopes, competition in international markets, and the value of overseas financial investments. Consequently, it is crucial for organizations to monitor currency dryness very closely to mitigate risks and enhance their monetary approaches.

How Does a Currency Volatility Meter Work?

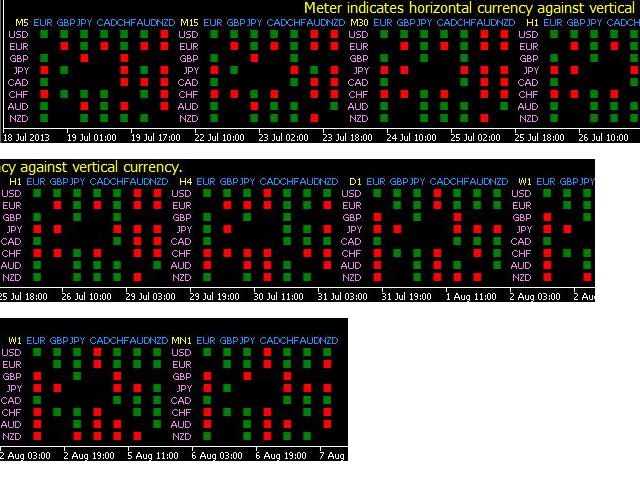

A currency dryness meter is a tool that procedure and keep track of the level of dryness in various unit of currencies. It delivers real-time data on how much a specific money's market value is probably to change over opportunity located on historical patterns and existing market disorders. Through analyzing this information, organizations and capitalists may make informed selections regarding their exposure to different money.

Benefits of Using a Currency Volatility Meter

1. FX Market : A currency volatility gauge assists organizations pinpoint possible risks connected with substitution fee changes. Through understanding which money are even more unpredictable than others, companies can change their risk administration approaches as needed. This might include bush procedures such as forward deals or options to secure versus damaging exchange cost activities.

2. Monetary Planning: Accurate foresights provided by a currency dryness meter allow organizations to plan their spending plans and cash money circulates more properly. By expecting potential modifications in substitution prices, firms may predict the effect on their revenue, expenditures, and revenue scopes. This info is indispensable for strategic decision-making and long-term financial strategy.

3. Very competitive Advantage: In inconsistent markets, having get access to to real-time unit of currency dryness record can easily give companies a reasonable side. Through closely monitoring currency activities, companies may determine chances to maximize pricing approaches, arrange ideal agreements with providers or consumers, and get into or go out overseas markets at the appropriate time.

4. Expenditure Opportunities: For capitalists looking to diversify their profiles globally, a currency dryness meter comes to be an essential resource. By examining the dryness of different currencies, real estate investors can easily determine opportunities for successful business or expenditures in international assets such as supplies or bonds. This helps spread out risk throughout different currencies and potentially boosts general yields.

5. Market Analysis: Currency dryness gauges provide beneficial insights in to market conviction and expectations concerning future exchange cost movements. This details is critical for carrying out thorough market review and creating informed opinions about macroeconomic fads that might impact company procedures or investment choices.

Final thought

In today's stormy markets where unit of currency worths are consistently altering, remaining ahead of time requires a deep understanding of unit of currency dryness. A money volatility meter gives services and real estate investors with real-time record on varying swap rates, making it possible for them to handle dangers efficiently, intend their financial resources purposefully, obtain a competitive perk, recognize financial investment opportunities, and create informed choices based on complete market analysis.

Through leveraging the electrical power of technology through a money dryness meter tool, you equip yourself along with the important devices to get through through unstable markets successfully. Essentially this will assist you remain ahead of time of your rivals and achieve your financial objectives in an ever-changing international economic situation.

(Keep in mind: Word matter - 803)